This article may include advertisements, paid product features, affiliate links and other forms of sponsorship.

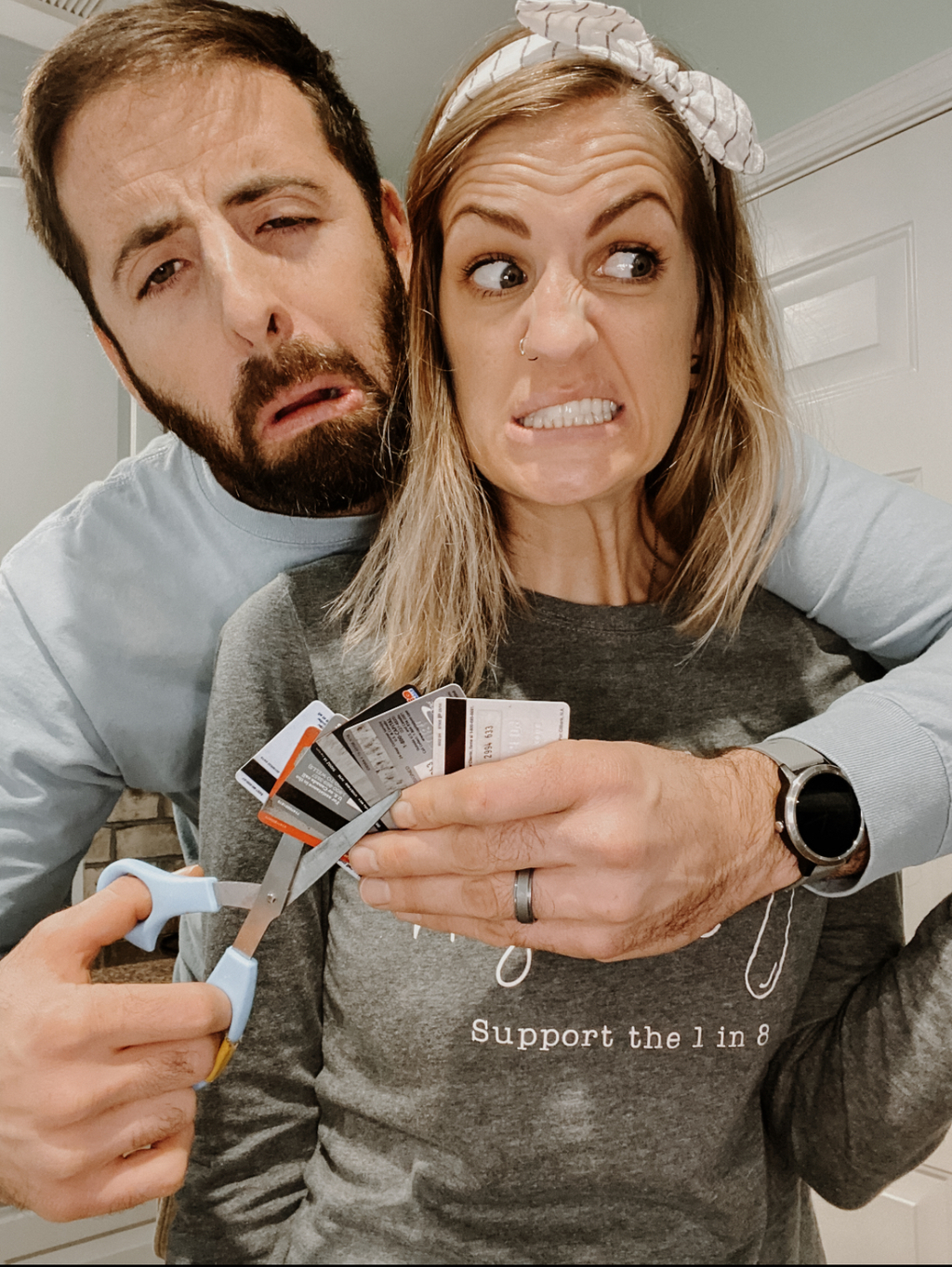

What if I told you that you weren’t allowed to spend any money for one month? Could you do it? If you’re like us, then you’re probably thinking, “Wait, that’s a thing?” YEP! It’s called a “no spend month” and here’s how it works:

NO ADDITIONAL SPENDING! You pay your bills and you buy groceries. That’s it!

A “no spend month” isn’t for the faint of heart. It’s quite the task to take on, but believe us when we say- it is worth it! Don’t believe us? Then check this out:

We dare you to sit down and calculate all of your unnecessary spending for a month. What do you think the final total would read? Would it be $10? Maybe $50? Is there a monetary value that you can justify “wasting” for a month?

A 2019 study of 325 people showed that 95% of people believe that people in the U.S. waste more money than they should. That’s shocking. What’s even more shocking is to find that during this study, people agreed to spendmore money than they should on additional fees/costs, overpriced beverages (guilty as charged!), and food waste. Do you find that you or your familyfit into any of those categories? If your answer was no, I invite you to read through the study here and see if there are any other areas of your financial spending in which you may be wasting your money.

Getting a handle on your monthly income and spending is no easy feat; however, it is doable! And to encourage you further, I’ll share a little bit of our financial background to show you why we chose to make a drastic change in our budget and spending habits.

My husband is 30 years old and I am 29. He is a contractor and owns his own business with his dad. I’m a Preschool teacher turned entrepreneur- a massive career shift that happened in early 2020 when we had our first child and Covid-19 shut down schools. We live comfortably, but I’ll be the first to admit that we have definitely increased our “wasteful spending” over the years. One of our biggest financial investments happened in 2019 when we did our first round of IVF, costing about $20,000. When tax season came in 2020, we realized that our IVF costs weren’t covered by insurance, nor did they apply for a tax write-off. That year we owed more in taxes than we ever have before, so we began seeking new methods for budgeting and saving money. We tried method after method, but the end of the month would come and two main areas were always over budget: eating out and miscellaneous/impulse purchases.

With the new year of 2021 on the horizon, we decided to buckle down and STOP the excuses. We did some research and found the term “no spend month” continuing to pop up on our radar. In furthering our research of what a “no spend month” was, we knew that this was right up our alley.

Quite the task to take on, huh? Especially for two people who could hardly stick to a budget to begin with. But we were determined to make a difference in our financial standing. Now hear me out on this, a “no spend month” can be really fruitful for you and your family, but it can also fall flat. The devil is in the details and it’s up to you to figure out how beneficial this will be.

If you want to set yourself up for success, here are five ways that you can plan and prep for a “no spend month” :

Plan Ahead

Make the decision to do a “no spend month” in advance. Whether it be a week or a month, do it ahead of time. We did our first “no spend month” in January of 2021 and we made the decision to do it almost a month in advance. This gave us plenty of time to do some digging in our finances to see what our overarching goal would be and how we could make it work. Having a month’s notice gave us time to mentally digest what we were doing and in the time leading up to our “no spend month,” it actually made me even more aware of my impulse to spend money.

My husband and I both took some time to do our own research and planning before officially coming together to create a final plan. We both came to the discussion with different perspectives and ideas. Plus, having time to think through it on our own, helped us to have an intentional and exciting conversation instead of an argument. Finances can be a touchy, hot-button topic in marriage, but when you make a plan to discuss it ahead of time, it can be more fruitful than a spur-of-the-moment conversation.

Planning ahead gives you time to discuss and finalize all the details for your “no spend month” while answering two main questions: When will you do it and how long will it last? Will you start off slow with a “no spend weekend” or a full-blown “no spend month?”

Set Ground Rules

Once you’ve established when your “no spend month” will be, it’s time to start thinking ground rules. These will look different for everyone because of the structure of your home and family. But at the most basic level, the ground rules serve the purpose of establishing what you want your “no spend month” to look like. Take this time to evaluate the costs in your home and determine what counts as an essential item vs. a non-essential item.

For us, take-out and overpriced coffee beverages did NOT count as an essential item; therefore, we set the rule that we could not have those items during our “no spend month.” The only exception is a gift card. If we had a gift card to a coffee shop or restaurant and wanted to use it during our “no spend month,” we could and it wouldn’t count against us. Some people say that personal hygiene items and cleaning care items are essential items and we would agree. But in order to avoid the temptation of going to the store, we chose to make sure we got what we needed or were low on prior to the “no spend month.” This is another area where planning ahead came in handy. We had ample time to figure out what we needed and could spread out the cost of buying additional items over the course of a month instead of all at once. Essential items would absolutely count expenses such as monthly bills, gas, groceries, medicine, prescriptions, etc.

It’s important to set up ground rules that you and your spouse or family can agree on. Make sure that everyone is on the same page and understands what’s to come. It may be helpful to create a list of essential items vs. non-essential items and have it hanging in plain view for everyone to see- maybe in a high traffic area like your kitchen or by the front door.

Read More: 5 Helpful Tips For Budgeting This Year

Make A Budget

Now comes the fun! What is a reasonable budget that your family can live off of for a month? Set up the different areas of your budget and break them down into your necessary expenses (groceries, gas, etc.). This can also be a good time to talk about why you’ve chosen the budget numbers you have. Look back on the expenses of a previous month for a good starting number. This will also be a good indicator of any area in which you may have budgeted for more than you need. For example, if you budget $500 for groceries, but find that you’re only spending a consistent $250, then shrink your grocery budget to the $250 and stick to it! Try to be as minimal as possible when crunching and setting up these numbers.

Remember: this isn’t your “forever” budget, it’s for one month!

Once you have all of your essential expenses accounted for, it’s important to look at the money you have remaining. There’s a good chance that you have a nice chunk of money left over, but what will you do with that money? Talk it over and figure out where this money will go. THIS IS SO IMPORTANT. Let me say it again, figure out and make a plan. Tell your money where you want it to go!

“A budget is telling your money where to go instead of wondering where it went.” -Dave Ramsey

Set up auto-withdraw or a reminder in your phone to keep you on track of where your money is going. For us, we decided to have a meeting on the evening of each payday so that we could shuffle funds and get our money where we needed it to go. Moving money all throughout the month helped us to stay true in our pursuit of saving, but also helped us to stay on our budget. Once the money was moved into a savings account, it was gone and we weren’t tempted to allow overspending in other areas such as groceries.

Set Financial Goals

Once you’ve established your budget and figured out how much money you have left, now it’s time to set some goals. What are you saving for? Is there a college fund that needs attention? Or maybe your rainy day fund could use a little extra love? Whatever it may be for you and your family, establish these financial goals and it will only enhance your persistence during your “no spend month.”

Your financial goals serve as your “WHY” and it’s crucial to have something worth fighting and saving for. It may be helpful for you to write down your financial goals and have them in plain sight. Write what you’re saving for on a sticky note and put it in your wallet by your credit or debit card. Maybe even try printing out pictures of your financial goals (trip destinations, etc.) and taping them on your fridge or in your car. It’s so helpful to have a visual of what you’re working towards and it will help you to fight the temptation of impulse buys or overspending.

Set a specific number in place for each account that you want to improve and take it out of your monthly budget. Don’t allow yourself to think that you have that money available to you. Make it off-limits and move portions of the money after each payday throughout your “no spend month.”

Read More: Real Ways To Save Money

Meal Plan

In the previously mentioned study, out of 335 people, 70% said that most commonly engage in wasting money by throwing out food and 54% said they frequently stop at a fast-food restaurant. If you’re like us, one of our biggest areas of overspending was take-out. Honestly, I get it. It’s an easier option. There’s no battle of “what’s for dinner” or “who’s going to cook?” Some days it’s just easier to say, “I’ll pick something up on my way home.”

But what we came to find is that those frequent stops at a restaurant would quickly add up. One stop at a fast-food joint for my husband and I would easily average out to be $15. If you’re doing that multiple times a week, you’re spending over $100 in extra food expenses. We are foodies and we love to support our local restaurants, but our “no spend month” really challenged us to create unique and versatile dishes in our own kitchen.

For our personal family and budget, we set our grocery budget of $250 and I allowed myself two trips to the store for the whole month. That means that I purchased two weeks’ worth of groceries for $125 and I made it last.

Meal planning doesn’t have to be fancy or elaborate. The basic purpose of it is to create nutritious meals without breaking the bank. Writing out your meal plan for two weeks is actually much easier than you think- I guarantee it! Don’t underestimate the power of a simple, yet tasty meal such as spaghetti and meatballs or breakfast for dinner and make sure to build in at least two nights for “leftovers” so that you can clean out the fridge and significantly cut down on food waste.

Meal planning during a “no spend month” will help you to learn to stay on a tight budget and avoid overspending at the grocery store because you won’t have a lot of wiggle room. Any additional spending will already be spoken for and moved into your savings account.

Read More: 10 Best Apps For Meal Planning

A “no spend month” is not a fad diet for your bank account. This is a strategic way to get your spending habits under control while also learning more about yourself. When you have a better understanding of your spending habits, you will have a better strategy for your saving habits. Starting a “no spend month” can be challenging, so make sure that you give yourself plenty of time to create a system that works for you and your family so that you can set yourself up for success. We wish you the best of luck and make sure you tag us in your journey to financial freedom when you decide to take on the “no spend month.”

💖 NEWSLETTER: DAILY READS IN YOUR INBOX 💖

Sign up to receive our picks for the best things to do, see and buy so you can relax and focus on more important tasks! Let us help you be the best version of yourself you can be!

GET MORE FROM DAILY MOM, PARENTS PORTAL

Newsletter: Daily Mom delivered to you

Facebook: @DailyMomOfficial

Instagram: @DailyMomOfficial | @DailyMomTravel | @BestProductsClub

YouTube: @DailyMomVideos

Pinterest: @DailyMomOfficial